Simplifying Cross Border Solutions, Powering Financial Innovation

Whether you’re a fintech startup, a global bank, an MTO, a lifestyle platform, or an entrepreneur, RemitOS delivers compliant, scalable infrastructure that abstracts complexity and empowers seamless international growth.

Strategic Solutions, Measurable Results

Delivering tailored solutions that streamline operations, reduce risk, and drive measurable growth.

Launch fast. Scale globally. Own the customer experience.

Features

- Ready-to-deploy web, iOS, and Android apps.

- Multi-currency wallets with automated FX routing.

- End-to-end KYC/AML compliance modules.

- Developer-friendly APIs and SDKs for custom flows.

Pain Points

- Slow time-to-market from bespoke builds and fragmented rails.

- High integration costs for payouts, FX, and compliance.

- Loss of brand control when relying on third-party platforms.

Solutions we Offer

- White-label full-stack platform for rapid branded launches.

- Pre-integrated payouts and FX rails to cut complexity and cost.

- API/SDK toolkit for fast partner, third-party and jurisdiction based license integration.

Securely extend your reach without replacing your core.

Features

- Secure API adapters that preserve existing core logic.

- Transaction routing and reconciliation engine.

- Audit trails and compliance dashboards.

- Scalable throughput with SLA-backed uptime.

Pain Points

- Legacy systems that are costly and risky to replace.

- Complex partner onboarding for cross-border payments.

- Regulatory and operational risk when connecting to new rails.

Solutions we Offer

- Non-intrusive API gateway and SDKs that connect legacy cores to modern payment partners.

- Managed global payout and CBS orchestration to simplify cross-border settlement.

- Compliance and license integration to reduce regulatory friction.

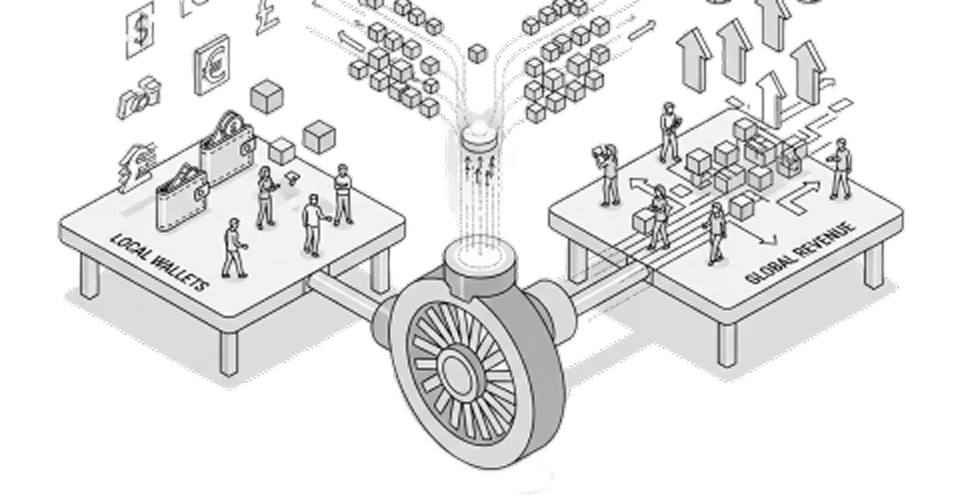

Turn local wallets into global revenue engines.

Features

- Multi-currency wallets and instant settlement options.

- White-label modules for remittance, merchant pay, and bill presentment.

- In-app FX pricing tools.

- Interactive dashboards.

Pain Points

- Domestic wallets lack international remittance capability.

- Low-margin domestic transactions limit monetization.

- Complex compliance & FX management for cross-border flows.

Solutions we Offer

- Multi-currency accounts + global payout integrations.

- Modular feature packs (remit, bill pay, merchant payouts) to increase revenue.

- Compliance automation for simpler cross-border KYC.

Our Proprietary Building Blocks

From pilot to production, customized for speed and efficiency.

Unified API

Routing, screening, KYC/KYB, reconciliation, and filings through one interface.

Dynamic routing

Real-time partner scoring by FX margin, SLA cut-offs, liquidity, latency, and success history.

Compliance-as-code

Versioned policy bundles with preflight checks and audit-ready evidence.

Reconciliation & reporting

Event-driven pipeline, unified ledger, dashboards, and exception packets.

White-label app

Branded web + mobile frontend running on our APIs.

Cross-Border Payouts

Beyond Borders – enable instant, secure global payouts via a unified API. Route transactions for efficiency, speed and compliance.

Licensing-as-a-Service

Our LAAS model delivers full regulatory compliance and market launch within weeks, cutting the typical 18-month self-licensing process. Available in selected jurisdictions; it turns licensing from a barrier into a competitive advantage.

Compliance Automation

Our platform provides automated Know Your Customer (KYC) and Know Your Business (KYB) processes, integrated sanctions screening, and real-time suspicious transaction reporting tailored to the requirements of each license jurisdiction.

Operations and Support

Continuous monitoring of licensing activities, compliance workflows, and transaction processes to ensure efficiency and accuracy; Round-the-clock support channels to address urgent issues, ensuring uninterrupted operations.

Single API Connectivity

One API connects you to licensing, compliance, KYC/KYB, sanctions screening, and reporting functions.

Frequently asked

Questions

Frequently asked

Questions

At RemitOS, we are building the operating system for cross-border money movement. Founded by a team with deep expertise in fintech, remittance, and regulatory compliance, our mission is to simplify and accelerate how financial institutions, fintechs, money transfer operators, entrepreneurs and others launch and scale payment services.

At RemitOS.ai, we provide a comprehensive suite of products designed to help companies launch and scale cross-border remittance services quickly and securely. Our offerings include:

- Full-Stack White-Label Solution

- API/SDK Integration

- License Integration

- Global Payouts and FX

- Customized Development Services

Legacy systems slow innovation with outdated technology, rigid architectures, cumbersome compliance and manual processes that lead to long release cycles. RemitOS is built for speed and flexibility, leveraging modern architecture, automation, and ready-to-use integrations. This enables businesses to launch products in weeks not months.

Yes, businesses can reduce integration overhead while unlocking access to multiple regulated markets through a single API. RemitOS is designed for quick onboarding with minimal setup time. The interface is intuitive, and most teams can start using the platform within hours, not weeks.

At RemitOS, we understand that every business has unique needs. That’s why we provide flexible pricing plans designed to adapt to your company’s size, growth stage, and feature requirements. Whether you’re a small business looking for a cost-effective solution or a larger enterprise seeking advanced functionality, our pricing is tailored to deliver maximum value.

To ensure you get the best fit, we encourage you to contact our sales team and schedule a personalized demo.

RemitOS cut our integration time by 60% and stabilized margins in volatile corridors.

Max Freeman

Head of Product, Neobank

Read the Full Case StudyOur platform reduced settlement errors by 85% and boosted cross-border.

Sarah Chen

VP of Operations, GlobalPay

Read the Full Case StudyWe achieved 99.9% uptime and saved $2.3M annually with automated compliance checks.

Raj Patel

CTO, FinSecure Bank

Read the Full Case Study

The challenge we solve

The challenge we solve

Legacy remittance systems create friction across routing, reconciliation, and compliance, increasing costs and slowing time to value. Fragmented tooling prevents consistent observability and makes it difficult to scale profitable payout programs