The Core OS for

Cross-Border Payments

One API to route, reconcile, and comply across licensed corridors. You build the experience. We orchestrate the rails.

RemitOS powers the future of

remittance infrastructure; Trusted partners handle

the funds, we deliver the technology that moves them

Multi-Jurisdictional:

Single Integration, Global Connectivity

Reduce integration overhead while unlocking access to multiple regulated markets through a single API.

Multi-Jurisdictional:

Single Integration, Global Connectivity

Reduce integration overhead while unlocking access to multiple regulated markets through a single API.

Compliance First:

Regulated by Design with Built-In Controls

Embedded compliance and partner licensing let you focus on growth while risk is managed continuously.

API First, Scale Fast.

Developer friendly APIs and modular services deliver rapid integration with clean endpoints and comprehensive docs to enable scalable expansion across borders.

Compliance First:

Regulated by Design with Built-In Controls

Embedded compliance and partner licensing let you focus on growth while risk is managed continuously.

API First, Scale Fast.

Developer friendly APIs and modular services deliver rapid integration with clean endpoints and comprehensive docs to enable scalable expansion across borders.

Operational Modules

A unified infrastructure that delivers compliant, scalable connectivity and operational control across global markets.

Transaction Monitoring:

Live transaction visibility

Real time transactions, balances, and settlement status; track failed or pending payments and initiate retries.

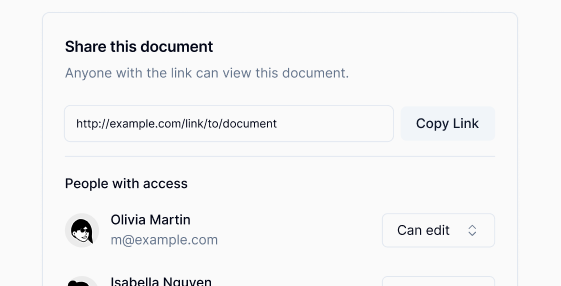

Account and User Management:

Centralized account controls

Manage sub accounts, roles, and permissions; streamline client onboarding and KYC verification.

Payouts and Settlement Controls:

Controlled payouts and liquidity

Schedule and approve payouts to end users; monitor liquidity and cross border settlement flows.

Compliance and Regulatory Reporting:

Audit ready compliance

Access KYC/AML records and generate regulator ready reports on demand.

Fraud and Risk Management:

Proactive risk detection

Receive alerts on suspicious activity, set thresholds, and automate monitoring rules.

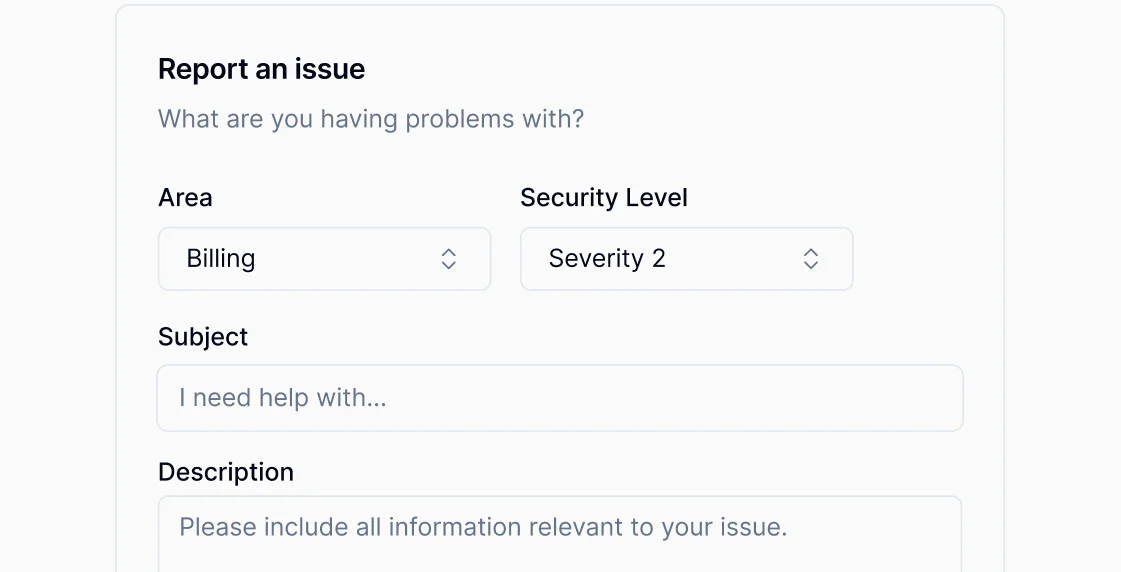

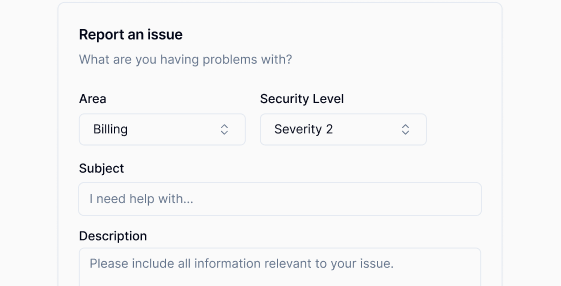

Analytics and Support:

Operational insights and case handling

Track volumes, revenue, and KPIs; export data for audits and submit/escalate support tickets.

Outcomes

Deliver measurable business results through compliant, auditable operations and scalable infrastructure.

Rapid Market Access

A single API, sandbox simulations, and standardized data contracts to cut integration time dramatically.

Dynamic FX and Liquidity Orchestrator

Real‑time partner scoring blends FX margin, liquidity, and success probability to preserve spreads per transaction.

Multi-Jurisdictional Compliance Engine

Versioned policy bundles, normalized match evidence, and event‑driven filings mapped to jurisdictional templates.

Support and SLA Routing

SLA‑aware routing, exception packets with trace data, and a unified ledger across partners.

Rapid Market Access

A single API, sandbox simulations, and standardized data contracts to cut integration time dramatically.

Dynamic FX and Liquidity Orchestrator

Real‑time partner scoring blends FX margin, liquidity, and success probability to preserve spreads per transaction.

Multi-Jurisdictional Compliance Engine

Versioned policy bundles, normalized match evidence, and event‑driven filings mapped to jurisdictional templates.

Support and SLA Routing

SLA‑aware routing, exception packets with trace data, and a unified ledger across partners.

Frequently asked

Questions

Frequently asked

Questions

At RemitOS, we are building the operating system for cross-border money movement. Founded by a team with deep expertise in fintech, remittance, and regulatory compliance, our mission is to simplify and accelerate how financial institutions, fintechs, money transfer operators, entrepreneurs and others launch and scale payment services.

At RemitOS.ai, we provide a comprehensive suite of products designed to help companies launch and scale cross-border remittance services quickly and securely. Our offerings include:

- Full-Stack White-Label Solution

- API/SDK Integration

- License Integration

- Global Payouts and FX

- Customized Development Services

Legacy systems slow innovation with outdated technology, rigid architectures, cumbersome compliance and manual processes that lead to long release cycles. RemitOS is built for speed and flexibility, leveraging modern architecture, automation, and ready-to-use integrations. This enables businesses to launch products in weeks not months.

Yes, businesses can reduce integration overhead while unlocking access to multiple regulated markets through a single API. RemitOS is designed for quick onboarding with minimal setup time. The interface is intuitive, and most teams can start using the platform within hours, not weeks.

At RemitOS, we understand that every business has unique needs. That’s why we provide flexible pricing plans designed to adapt to your company’s size, growth stage, and feature requirements. Whether you’re a small business looking for a cost-effective solution or a larger enterprise seeking advanced functionality, our pricing is tailored to deliver maximum value.

To ensure you get the best fit, we encourage you to contact our sales team and schedule a personalized demo.

Transforming

Cross-Border Landscape

RemitOS delivers next-generation payment infrastructure that enables clients to effectively serve global diasporic communities.

RemitOS cut our integration time by 60% and stabilized margins in volatile corridors.

Max Freeman

Head of Product, Neobank

Read the Full Case StudyOur platform reduced settlement errors by 85% and boosted cross-border.

Sarah Chen

VP of Operations, GlobalPay

Read the Full Case StudyWe achieved 99.9% uptime and saved $2.3M annually with automated compliance checks.

Raj Patel

CTO, FinSecure Bank

Read the Full Case Study